There are thousands of investment and trading companies worldwide that support transactions in assets like foreign exchange, cryptocurrencies, gold, oil and other volatile products. More and more private investors are trading online as interest rates drop for less risky financial products and keeping money in the bank becomes less attractive. As a result of the increased popularity amongst consumers, the number of trading & investment scammers has grown exponentially.

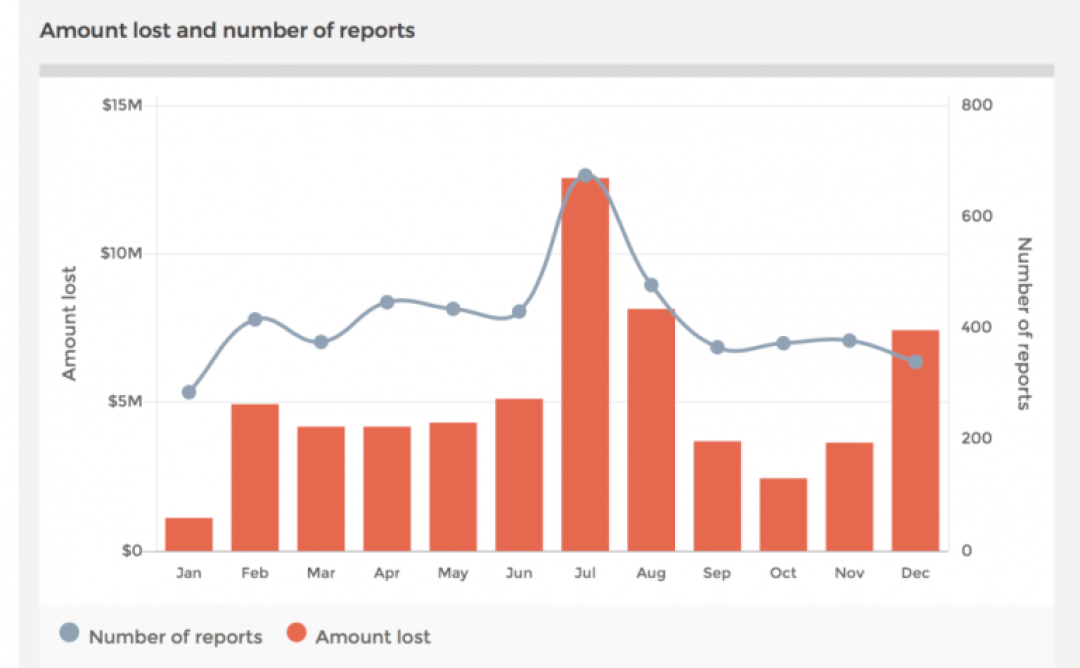

Scamwatch Australia, for example, reported more than $61.6 million AUD in losses due to fraudulent investment schemes in 2019. This is nearly a 60% increase compared to 2018 when the Australians reported $38.8 million AUD lost. This amount is, of course, a fraction of the money lost globally as Australia only has 24 million inhabitants.

Apart from all the standard checks you can do (read our blog post How to Recognize a Scam), we have several additional tips for identifying possible trading and investment scammers:

If they are not transparent and honest through all these questions, they are probably a scam. One lie is a strong indicator that there are a lot more lies behind it.

We recommend you to always work together with an investment and trading company based in your own country. There are two reasons for this:

Below is a list of the financial regulators of various countries:

If you do not see your country listed above, Wikipedia and ForexBonuses provide additional information.

What are High Yield Investment Programs (HYIPs)?

How to Identify Cryptocurrency Investment Scams

Sources:

We make every effort to bring you the most accurate information we can, but nobody’s perfect. Always check a website yourself. If we’ve made a mistake or can improve, please let us know. The information in this service is for general information purposes and we are not responsible for any damages or other negative consequences arising from it. For our full disclaimer, click here.